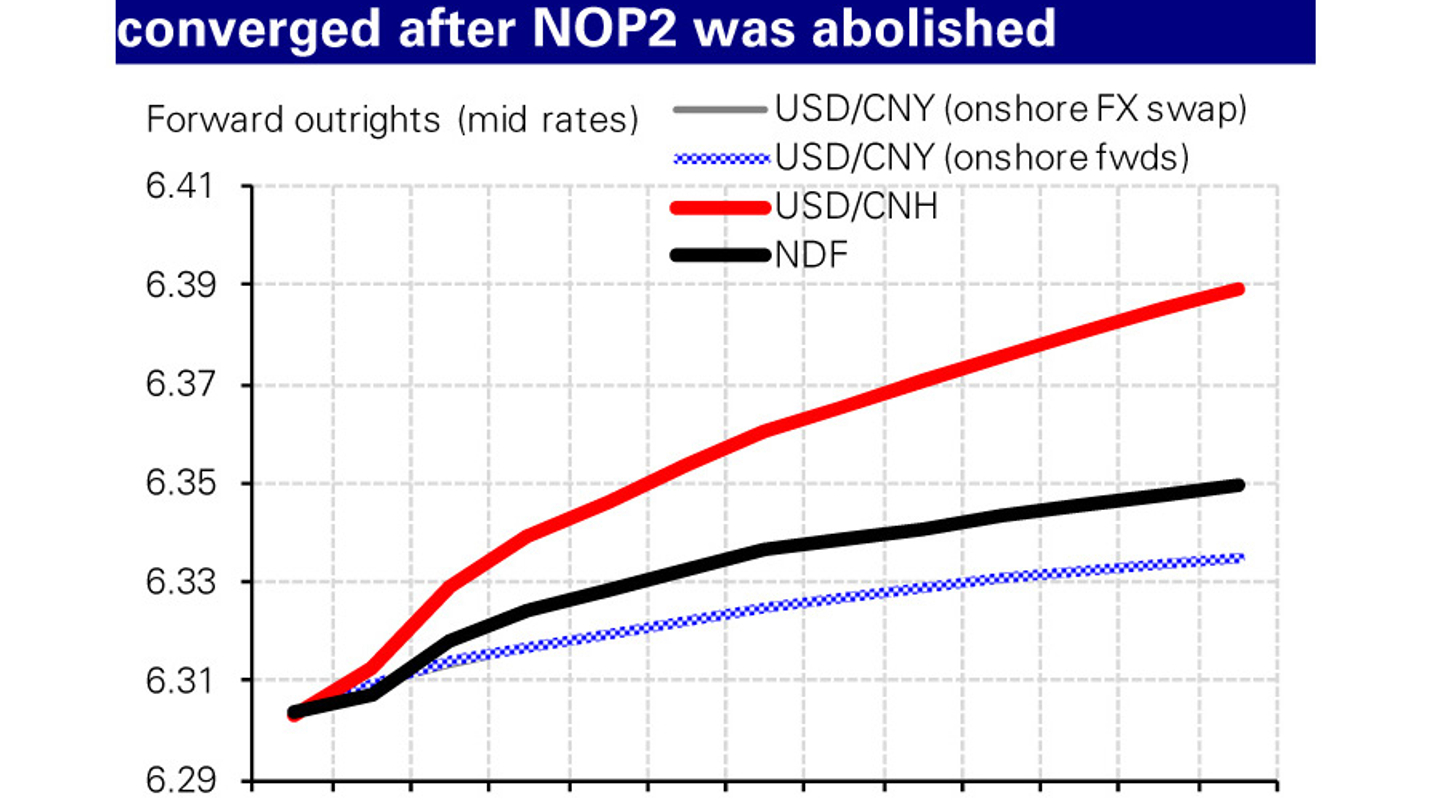

FX forwards now more attractive in China

The foreign exchange regulator for China has scrapped a restricting limit on FX exposure for onshore banks, making it cheaper for banks to offer FX forwards to CFOs.

In step with the news China has widened its currency trading band, the State Administration of Foreign Exchange (Safe) also announced changes to the net open position (NOP) limit for onshore banks in China.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to CorporateTreasurer.

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

If you are a treasurer, CFO or senior professional at a corporate or SME, please register for free VIP access here.

Questions?

See here for more information on licences and prices, or contact [email protected].

© Haymarket Media Limited. All rights reserved.

Top news, insights and analysis every Tuesday & Thursday

Free registration gives you access to our email newsletters

for unlimited access to all articles, newsletters