TOP TIPS: The consequence of Moody's bank downgrades

On June 21 Moody's downgraded the credit ratings of 15 global banks by a number of notches. The markets appeared uninterested but the impact on corporate treasury trade finance will hurt. We ask Olivier Hubert, treasury consultant at AlterCFO, to explain what that pain will be.

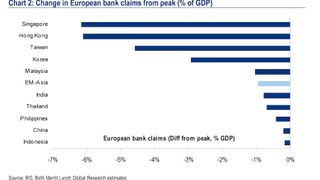

An Asian reality: For export oriented Asian companies highly dependent on the US and Europe, this is bad news. This downgrade affects their EU and US counterpart importers who are no longer able to obtain short term credit facilities, bank guarantees they've been used to. Some of our clients are now coping with orders that are delayed, cancelled or put on hold.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to CorporateTreasurer.

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

If you are a treasurer, CFO or senior professional at a corporate or SME, please register for free VIP access here.

Questions?

See here for more information on licences and prices, or contact [email protected].

© Haymarket Media Limited. All rights reserved.

Top news, insights and analysis every Tuesday & Thursday

Free registration gives you access to our email newsletters

for unlimited access to all articles, newsletters