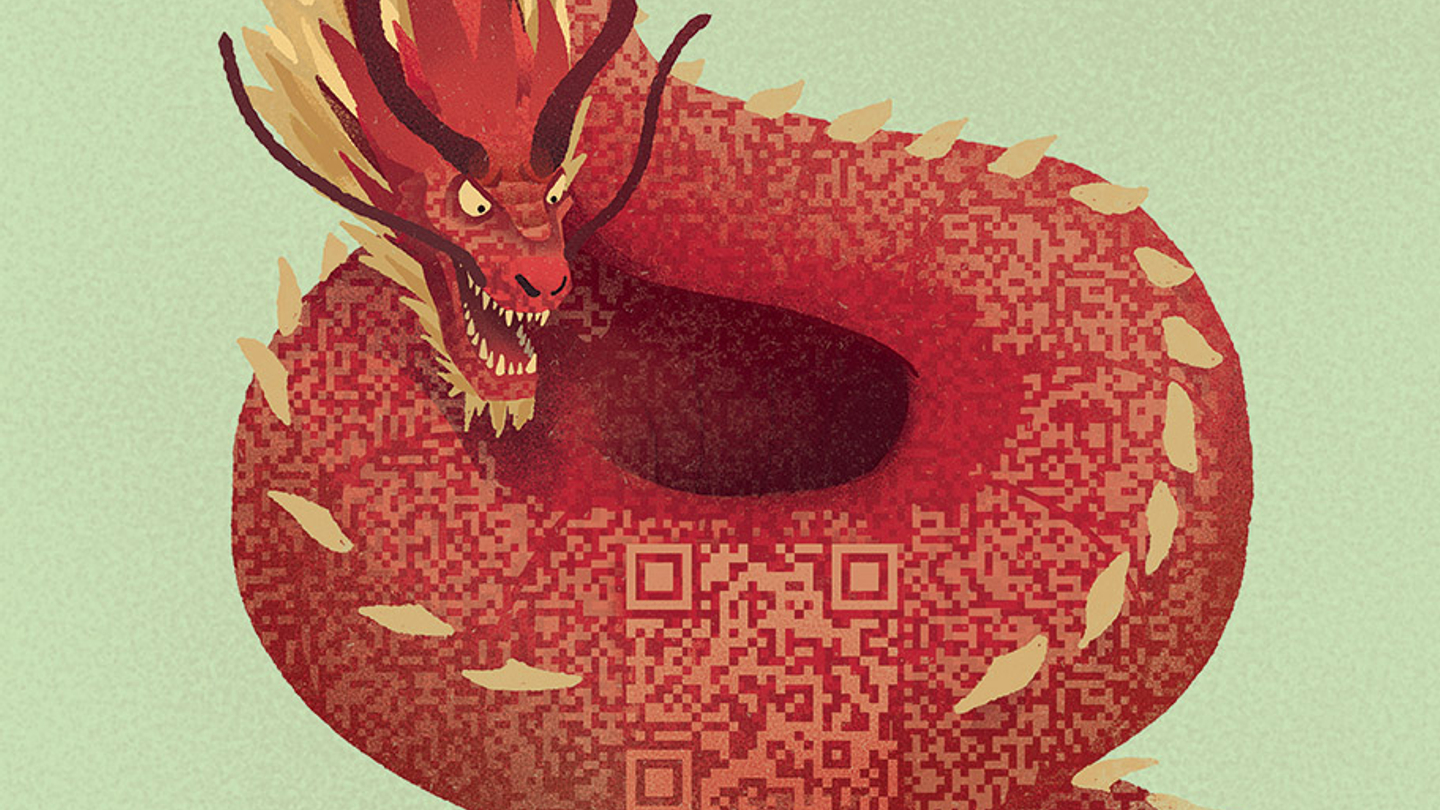

The roaring 20s: will China be first with a central bank-backed digital currency?

It seems fitting that China - the first country in the world to invent paper money - should also be the first to go cashless. But could it create more problems, particularly for payments, than it solves?

We are barely two weeks into 2020 and the topic of central bank-backed digital currencies (CBDCs) – central banks’ answer to open platform crypto assets such as bitcoin, and a counterweight to the threat of hegemony inherent in Facebook’s proposed Libra coin – is back in the headlines.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to CorporateTreasurer.

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

If you are a treasurer, CFO or senior professional at a corporate or SME, please register for free VIP access here.

Questions?

See here for more information on licences and prices, or contact [email protected].

© Haymarket Media Limited. All rights reserved.

Top news, insights and analysis every Tuesday & Thursday

Free registration gives you access to our email newsletters

for unlimited access to all articles, newsletters