Counterparty risk: Sumitomo's CDS narrows 9.9%

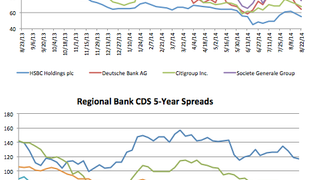

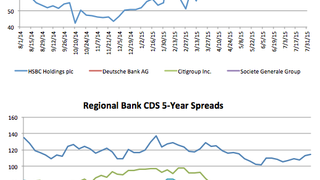

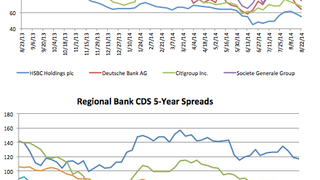

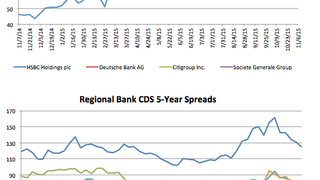

The latest five-year CDS spreads of global and regional banks, provided by S&P Capital IQ.

In partnership with S&P Capital IQ, CT provides a regular snapshot of the most recent movements in bank credit default swap spreads (CDS).

We have chosen five-year spreads as the benchmark as they are generally considered the most liquid and therefore offer more accurate barometer of risk appetite.

We believe this should be a welcome addition, although CDS levels are not in any way a perfect guide to monitor credit risk. Click here for CT's research on the benefits and pitfalls of using CDS as a measure.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to CorporateTreasurer.

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

If you are a treasurer, CFO or senior financial professional at a corporate or SME, please register for free VIP access here.

Questions?

See here for more information on licences and prices, or contact [email protected].

© Haymarket Media Limited. All rights reserved.

Top news, insights and analysis every Tuesday & Thursday

Free registration gives you access to our email newsletters

for unlimited access to all articles, newsletters