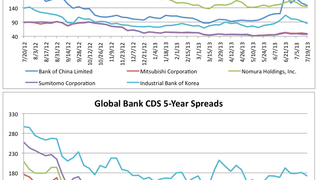

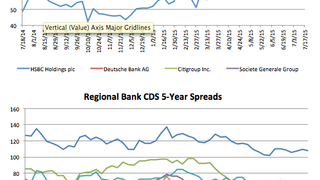

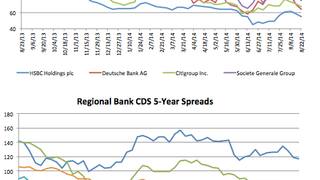

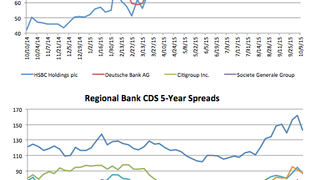

Counterparty risk: CDS tightens across the board

The latest five-year CDS spreads of global and regional banks, provided by S&P Capital IQ.

In partnership with S&P Capital IQ, CT provides a regular snapshot of the most recent movements in bank credit default swap spreads (CDS).

We have chosen five-year spreads as the benchmark as they are generally considered the most liquidly traded and therefore offer more accurate barometer of risk appetite.

Sign in to read on!

Registered users get 2 free articles in 30 days.

Subscribers have full unlimited access to CorporateTreasurer.

Not signed up? New users get 2 free articles per month, plus a 7-day unlimited free trial.

If you are a treasurer, CFO or senior financial professional at a corporate or SME, please register for free VIP access here.

Questions?

See here for more information on licences and prices, or contact [email protected].

© Haymarket Media Limited. All rights reserved.

Top news, insights and analysis every Tuesday & Thursday

Free registration gives you access to our email newsletters

for unlimited access to all articles, newsletters